Sustainability Disclosure

The Continually Increasing 600

Today there are more than 600 different sustainability reporting standards, industry initiatives, frameworks, and guidelines around the world, which can make sustainability reporting a complex, research-heavy, and repetitive process.

Sustainability Disclosure

01

Mandatory disclosure (Bursa, BNM, ESRS)

02

Voluntary reporting (GRI, SBTI, CDP)

03

Industry specific disclosure

04

Investor/customer requirement

05

ESG metrices

Communicate your sustainability results and progress effectively with reports that comply with international regulations and protocols. We customized the reporting to your specific business requirements to speak precisely to your internal and external stakeholder interest.

Regardless of company size and type, ESG reporting is now essential

ESG reporting has become essential across all companies, regardless of size or type, driven by increasing stakeholder demands for transparency and regulatory shifts such as Bursa Malaysia’s impending transition from TCFD disclosure to IFRS S1 and S2. This global trend towards standardized reporting integrates sustainability factors with financial disclosures, bolstering transparency and resilience amid evolving market expectationsIGS consulting company is positioned to assist by streamlining regulatory compliance, enhancing transparency, and aligning sustainability reporting with international standards such as IFRS S1 and S2. This ensures our clients effectively meet evolving market and stakeholder expectations.

What you can expect?

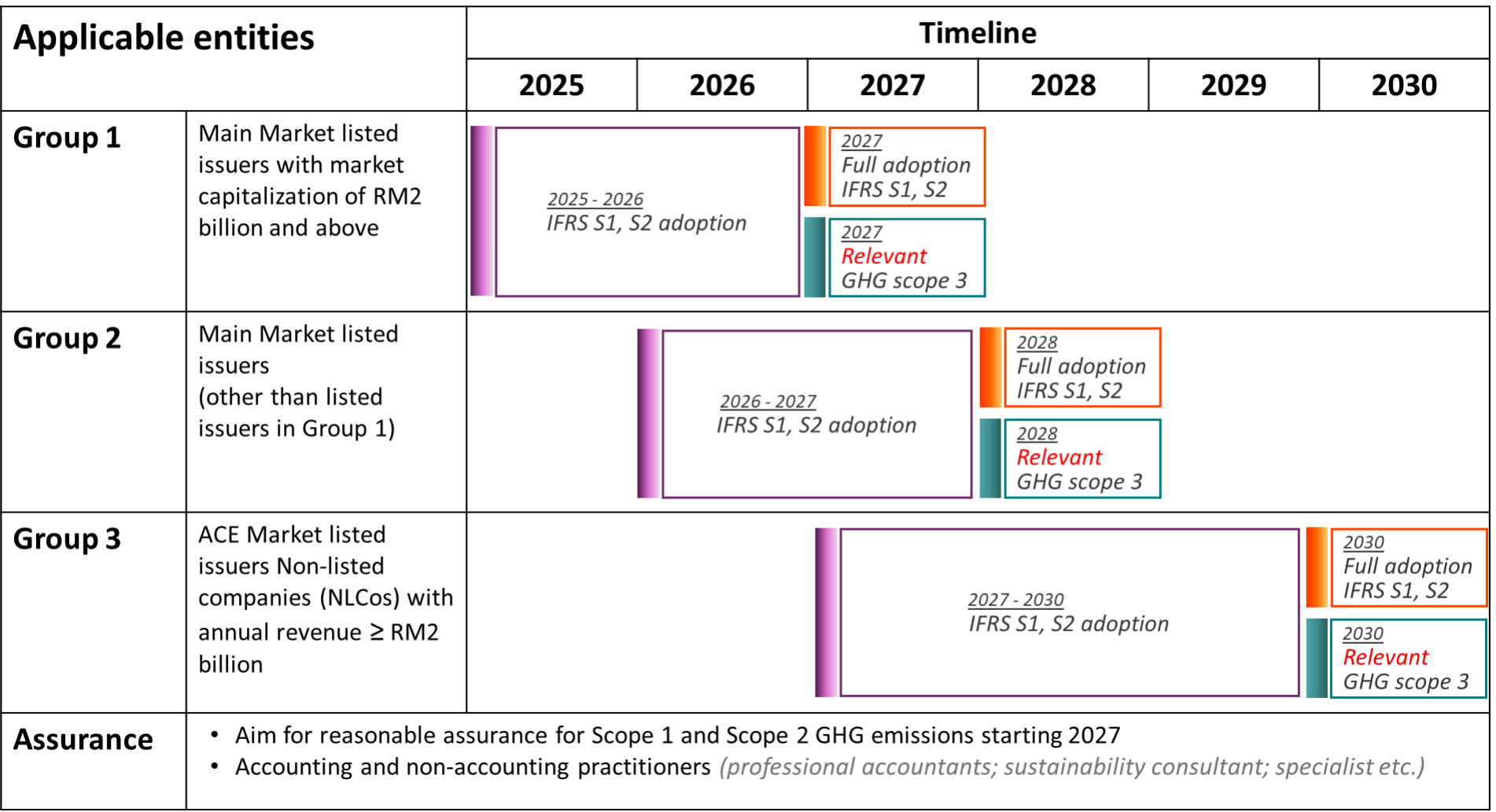

Key outcomes of the NSRF Proposal

1. Adoption of IFRS S1 and S2

The National Sustainability Reporting Framework (NSRF) outlines the phased adoption of IFRS S1 (General Requirements for Sustainability-related Financial Disclosures) and IFRS S2 (Climate-related Disclosures) standards in Malaysia. These standards serve as the baseline for sustainability reporting and will gradually replace the current Task Force on Climate-related Financial Disclosures (TCFD) requirements. The aim is to enhance transparency, accountability, and global comparability in sustainability reporting across companies in Malaysia. This alignment will allow Malaysian businesses to remain competitive on the global stage while contributing to the nation’s sustainability goals, including the United Nations Sustainable Development Goals (SDGs) and the ambition for a low-carbon, resilient economy.

2. Sustainability Assurance

The NSRF underscores the necessity of sustainability assurance to foster transparency and credibility in reporting, addressing concerns over greenwashing. Initially, the framework recommends voluntary assurance, but it will progressively mandate reasonable assurance for Scope 1 and Scope 2 greenhouse gas (GHG) emissions starting in 2027 for large market-listed companies. This assurance framework, which will be aligned with the Malaysian Institute of Accountants (MIA) standards, aims to instill greater investor confidence, providing the same level of trust as financial audits. Further details on external assurance providers will be announced following consultation with relevant stakeholders.

3. Implementation Timeline

The NSRF outlines a clear implementation timeline for adopting the IFRS S1 and S2 standards. For Main Market-listed issuers with market capitalization above RM2 billion, the adoption begins with reporting periods starting on or after 1 January 2025. Other Main Market issuers will follow by 2026, while ACE Market and non-listed companies (NLCos) will have until 2027. Full adoption for Scope 3 GHG emissions disclosures is expected by 2030. The NSRF also provides additional transition reliefs to support companies, particularly those in principal business segments, to meet the disclosure requirements

Read more: NSRF

What you need to prepare now

- Familiarization with IFRS S1 and S2 requirements

- Internal capacity building

- Develop robust data management system

- Assurance readiness

- Develop scenario analyses and transition plans

Are You Confident About the Key ESG Metrics You Need to Disclose?

To prepare for a voluntary ESG disclosures, it’s essential to understand both the critical metrics that are commonly disclosed and the areas of increasing investor focus. Companies venturing into ESG reporting without a comprehensive understanding of the sustainability ecosystem may struggle to determine which metrics are necessary for disclosure.

Climate-related disclosures are particularly crucial, as climate change remains a central focus in ESG reporting. Investors are keenly interested in how companies are addressing climate risks, setting goals, and tracking progress. Alongside environmental metrics, there is a growing emphasis on social and human capital metrics. Investors are increasingly scrutinizing how companies manage social issues such as diversity, equity, and inclusion (DEI), labor practices, and community engagement. These social aspects are becoming as critical as environmental concerns, with investors seeking more comprehensive assessments of company strategies that extend beyond environmental factors.

Investors expect more than just basic disclosures; they want to see ESG considerations integrated into the core business strategy. This includes setting long-term goals, particularly in climate and social governance, and demonstrating measurable progress toward these objectives. As concerns about greenwashing grow, it is crucial that disclosures are accurate, transparent, and supported by robust data management systems.

Governance disclosures are also a significant area of interest for investors. These disclosures provide insight into how a company is managed and how it mitigates risks, which are essential for assessing long-term viability and stability. Effective governance disclosures, including details on board composition and diversity, executive compensation, and ethics and compliance, help build investor confidence by demonstrating that the company is committed to high standards of governance and is proactive in addressing potential risks and challenges.

Our ESG core metrics disclosure

Environment

- Scope 1 & 2 GHG emission

- Emission intensity

- Climate Resilience

- Water

- Energy

- Waste

Social

- Diversity, equity, and inclusion (DEI)

- Human Rights

- Occupational Safety and Health

- Labor Practices

- Employee development

Governance

- Board diversity

- ABAC (anti bribery anti corruption)

Others (As Per Business Needs)

- Procurement practices

- Community investments

- Supply chain performance

- Executive compensation

- Others (customized to meet the specific needs of each company)

At IvyGreen Solutions (IGS), we ensure that our ESG metrics disclosure is comprehensive, accurate, and aligned with both international and local standards. We meticulously consider globally recognized frameworks such as the Global Reporting Initiative (GRI), International Financial Reporting Standards (IFRS), and Bursa Malaysia’s requirements to provide disclosures that meet the standards of transparency and accountability.

Understanding the evolving landscape of ESG reporting, we stay ahead by integrating the latest trends and expectations from investors and stakeholders. This includes emphasizing areas that are gaining prominence, such as climate-related financial disclosures, human capital management, and governance practices. By doing so, we ensure that our ESG metrics disclosures not only comply with regulatory requirements but also address the critical concerns and interests of our stakeholders.

Our approach is designed to fulfill the diverse needs of all stakeholders, from investors seeking robust risk management practices to customers and partners who prioritize sustainable and ethical business operations. Through this comprehensive strategy, we ensure that our ESG metrics disclosures are not only compliant but also instrumental in driving meaningful engagement and long-term value creation.